Sumup

A better way to get paid

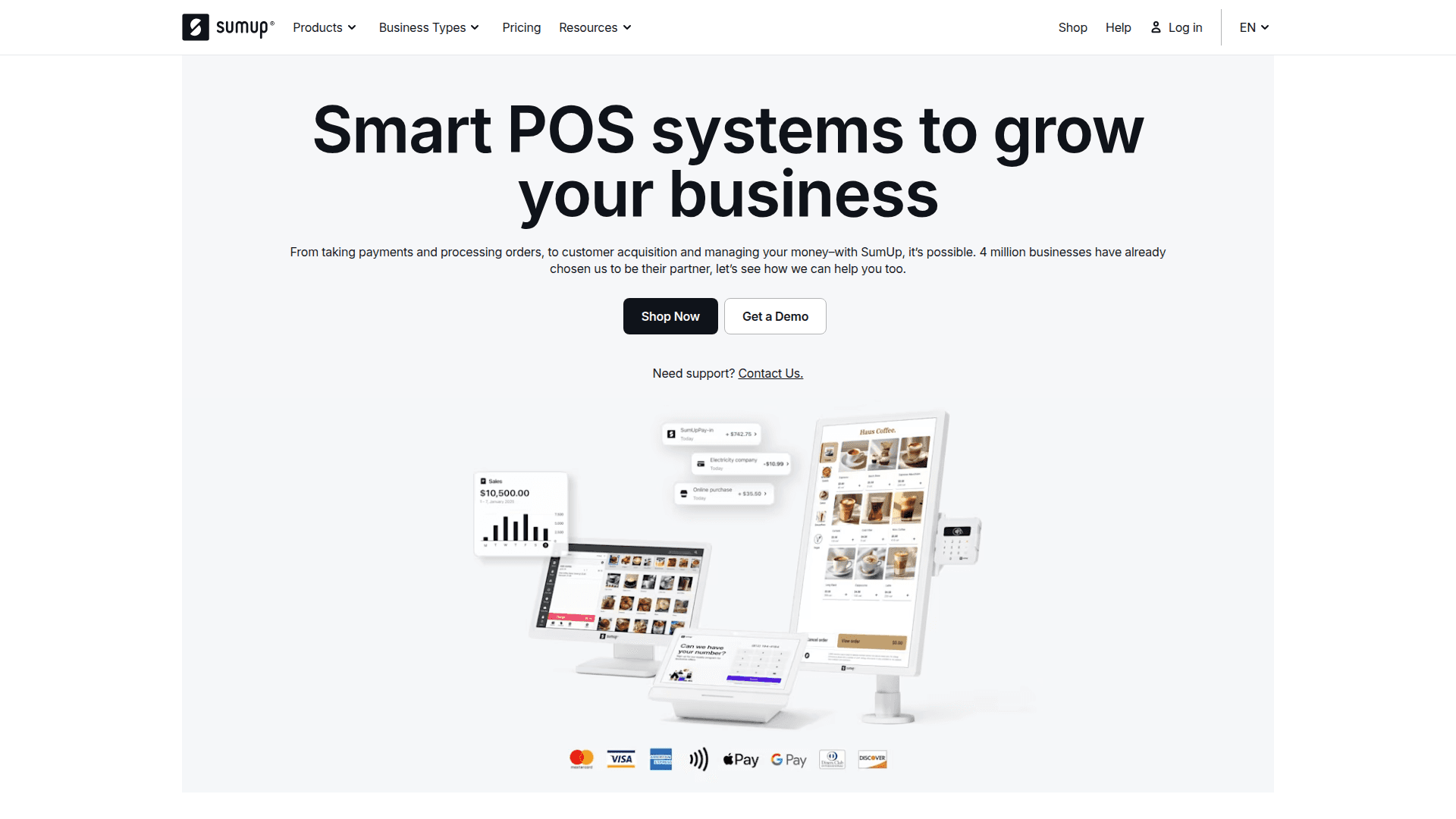

SumUp provides smart POS systems and payment solutions, helping millions of businesses accept payments, manage operations, and grow with affordable tools and transparent pricing.

What SumUp is (in plain English)

SumUp is an all‑in‑one way to take payments and run day‑to‑day ops without a big upfront investment or long contracts. Think card readers, a simple POS, online payments, invoicing, and even a business bank account—built to be easy and affordable for small and growing teams. (sumup.com)

Who it’s great for

Solo operators and microbusinesses that need a low‑cost, no‑drama way to accept cards anywhere. (sumup.com)

Retail, QSR, and service businesses that want a straightforward POS now, with room to add loyalty, marketing, and deeper tools later. (sumup.com)

What you get (the essentials)

Mobile card readers made for the real world

SumUp Plus pairs with your phone; accepts chip, tap, and swipe; and lasts for hundreds of transactions per charge. (sumup.com)

SumUp Solo is a standalone touchscreen reader with Wi‑Fi and built‑in unlimited data via SIM—no phone required. (sumup.com)

Point of sale that fits how you work

POS Lite: a clean, countertop setup with a 13" touchscreen + Solo reader. No monthly software fee, with essentials like inventory, tips, refunds, and clear reports. Perfect for getting started fast. (sumup.com)

Advanced POS and Loyalty: for growing teams that want customer rewards, automated marketing, a customer display, appointments, and built‑in QuickBooks connectivity. Plans start from a monthly subscription. (sumup.com)

Online and remote payments

Payment links, keyed‑in, and online checkout let you get paid even when the card isn’t present. (sumup.com)

Invoicing that’s actually simple

Create and send unlimited invoices, let customers pay online, track status, and see everything in one dashboard—no fixed software cost. (sumup.com)

A business bank account to keep money moving

Open a free SumUp Business Bank Account (banking by Piermont Bank, Member FDIC) with a free Mastercard debit card, no monthly fee, and everyday limits suited to small businesses. Same‑day ACH options and fast payouts help cash flow. (sumup.com)

Support that’s easy to reach

US‑based support by phone and email, plus a self‑serve Help Center for account setup and policy questions. (sumup.com)

Pricing that stays simple (US)

No monthly minimums. No long‑term contracts. No surprise fees. (sumup.com)

Current published US processing rates:

In‑person: typically 2.6% + 10¢ per tap, dip, or swipe. (sumup.com)

Keyed/online: typically 3.5% + 15¢. (sumup.com)

Invoice payments (online): typically 2.9% + 15¢; creating and sending invoices is free. (sumup.com)

Note: Some partner promos or pages may show different flat rates; your exact fees are shown in your account. (sumup.com)

Why this matters for a solid Back Office

Clean, centralized records from day one. Card, online, and invoice payments feed one dashboard, so sales, refunds, tips, and payouts line up without extra spreadsheets. That means fewer reconciliation headaches. (sumup.com)

Inventory and item catalogs that actually update. POS Lite auto‑adjusts stock as you sell, so you can spot fast‑moving items and reorder with confidence. (sumup.com)

Cash‑flow friendly payouts. Typical payouts land quickly, with options for faster movement when using the SumUp Business Bank Account. Less waiting, more working. (sumup.com)

Accounting‑ready exports and integrations. Pull reports anytime and connect advanced POS to tools like QuickBooks as you scale. (sumup.com)

Predictable costs make planning easier. Flat, transparent pricing helps you forecast margins and avoid the classic “gotcha” fees that blow up budgets. (sumup.com)

Room to grow without re‑platforming. Start with a reader or POS Lite; add loyalty, marketing, kiosks, or a customer display when you’re ready. Your ops can mature step‑by‑step. (sumup.com)

Practical details teams ask about

Payment types: Accept major cards plus Apple Pay and Google Pay out of the box. (sumup.com)

Hardware reliability: Long battery life and sturdy, splash‑resistant POS Lite hardware for busy counters. (sumup.com)

Connectivity flexibility: Solo includes Wi‑Fi and built‑in mobile data so you can take payments away from the counter. (sumup.com)

Policy fit: Some industries are restricted by card schemes/banking rules—check the restricted‑business list during signup. (help.sumup.com)

What makes SumUp stand out

Start fast, learn fast. Setup is quick, the app is intuitive, and you can be live in minutes—not weeks. (sumup.com)

Built for small teams, proven at scale. Millions of merchants use SumUp globally; the US product now includes a broader ecosystem (POS, loyalty, invoicing, banking) as it doubles down stateside. (sumup.com)

Growing ecosystem and partnerships. From loyalty and customer displays to enterprise‑grade features (including offline‑capable setups through partners), there’s a clear roadmap for more capability as you need it. (sumup.com)

Bottom line

If you want smart POS and payments that keep your back office tidy—with simple fees, fast onboarding, clean reporting, and upgrade paths as you grow—SumUp is a strong, low‑friction choice for getting paid and staying organized. (sumup.com)

Quick recap (at a glance)

Accept payments anywhere with Plus (phone‑paired) or Solo (standalone). (sumup.com)

Start on POS Lite with no monthly software fees; level up to advanced POS, loyalty, and marketing when you’re ready. (sumup.com)

Send invoices for free and only pay when customers pay online. (sumup.com)

Keep cash flowing with fast payouts and a free Business Bank Account. (sumup.com)

Plan with confidence thanks to simple, transparent pricing. (sumup.com)

Notes for US teams: Rates and device prices can vary by plan, promotion, or partner offer; confirm your exact terms in your SumUp account during signup. (sumup.com)